what is my income tax number malaysia

What is the Personal income tax rate in Malaysia for 2020. Income earned by residents are subjected to a scaled income tax rates from 0 to 28.

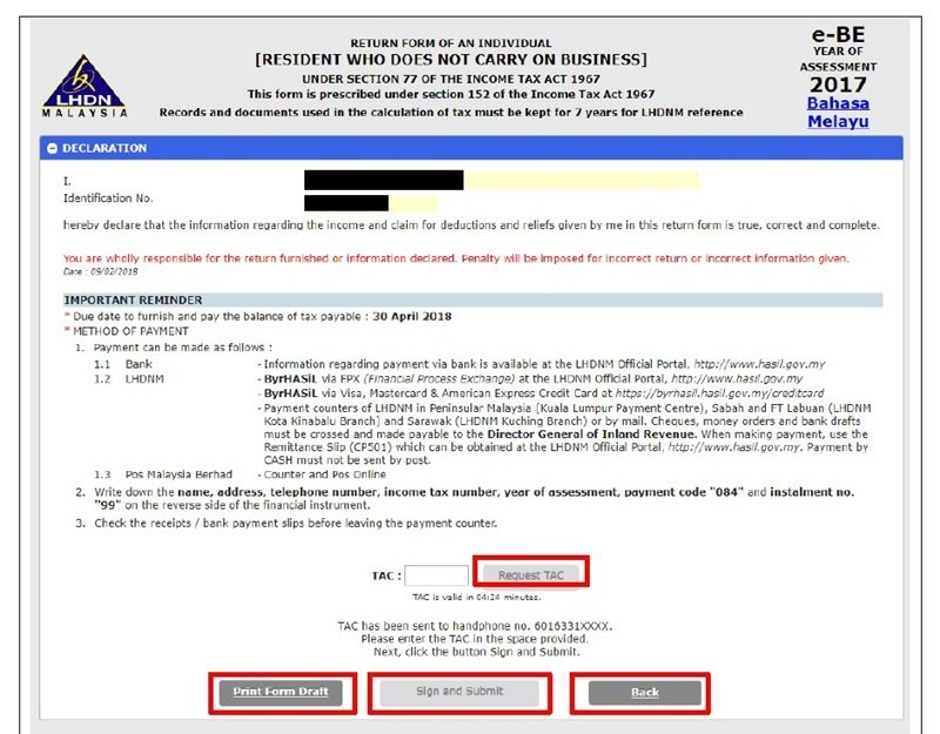

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

The rate of tax for resident individuals for the assessment year 2020 are as follows.

. Who should file income taxes. Reduction in personal income tax by 20 percentage points for salary between RM50001 and RM100000 and RM100 e-wallet credit for M40 group as announced in. Malaysia Personal Income Tax Rate.

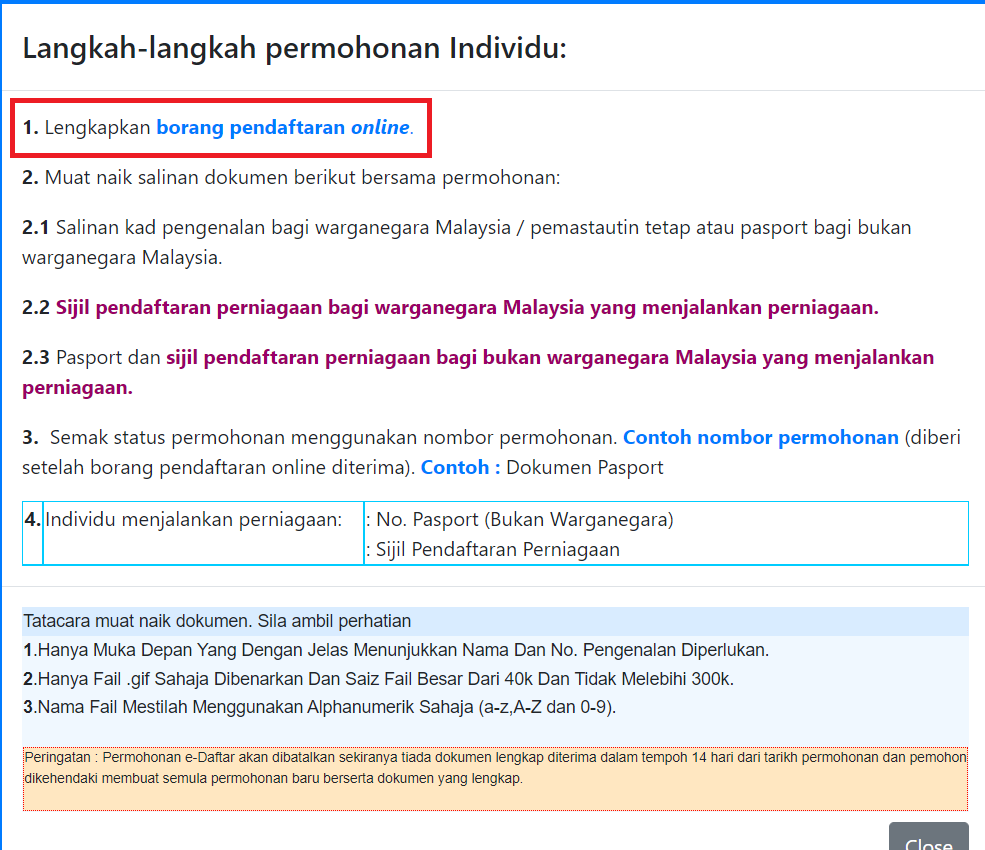

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp. Httpmaklumbalashasilgovmyborangaduanphp Just fill up the form and request for them.

Malaysian Income Tax Number ITN or a functionally comparable identification number It is a 12-digit number that is only granted to Malaysian citizens and permanent. Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the IRBM to identify its taxpayers. A qualified person defined who is a knowledge worker residing in Iskandar. A Copy 1 Memorandum and Articles of Association 2.

You can check your income tax number via the following. However if you claimed RM13500 in tax. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay.

An individual resident or non-resident is taxable if they earn an annual employment income of at least RM34000 after the EPF deduction. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. If you were previously employed you may already have a tax number.

A message stating that your application has been received will. It is also commonly known in Malay as Nombor Rujukan Cukai. Youll then see a page with your tax reference number and LHDN branch.

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. Whereas for non-residents income earned would be subjected to a flat tax rate of 28. Section II TIN Structures 1 ITN The ITN consist of maximum.

Starting from January 2021 all Malaysians above the age of 18 and corporate entities will be assigned a Tax Identification Number TIN said Deputy Finance Minister Datuk. Note these down for reference. The tax rate for 20192020.

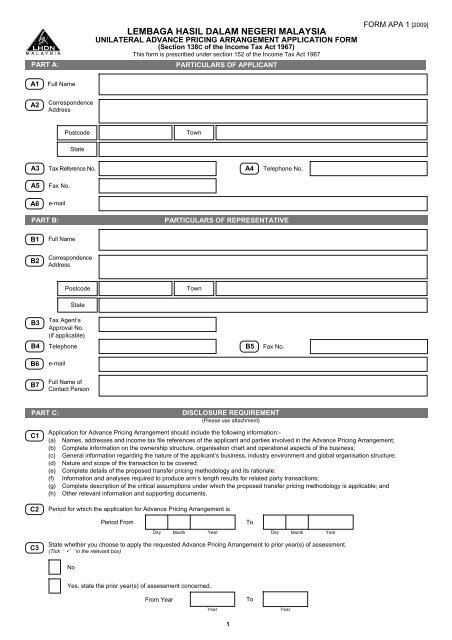

The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia. Our calculation assumes your salary is the same for 2020 and 2021.

Registering for a Malaysian tax number is not very. If you are staying in Malaysia for more than 182 days in a year you are considered resident under Malaysian tax law and have to pay taxes. A 10-digit number assigned by SARS to each taxpayer upon registration as a taxpayer is known as an income tax reference number.

Choose your identification type New IC. Lembaga Hasil Dalam Negeri Malaysia. In the event that you are registered.

Forward the following documents together with the application form to register an income tax reference number E-Number- 1.

Malaysia Personal Income Tax Guide 2020 Ya 2019

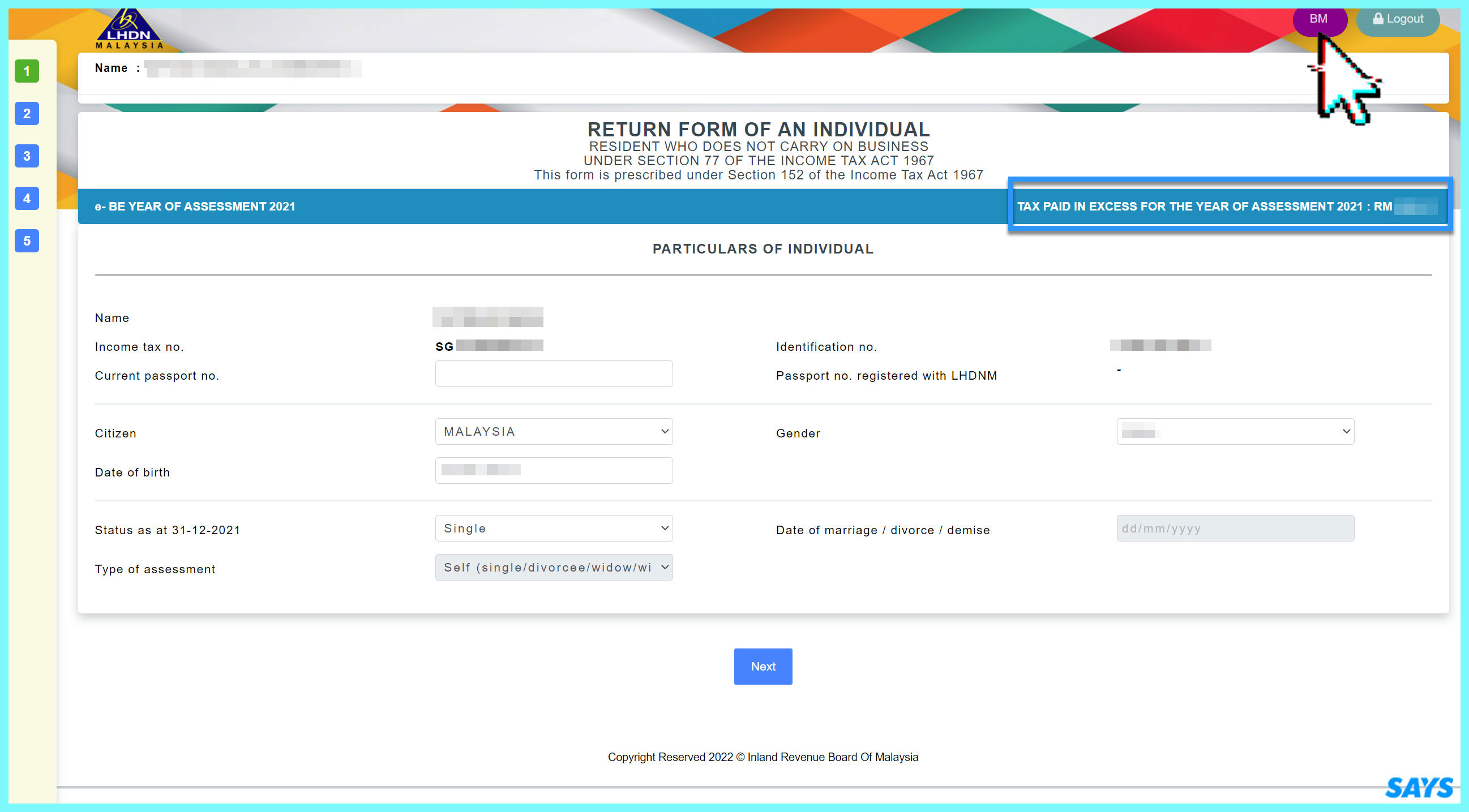

How To File Income Tax For The First Time

Estimating The Underground Economy From The Tax Gap The Case Of Malaysia Semantic Scholar

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World

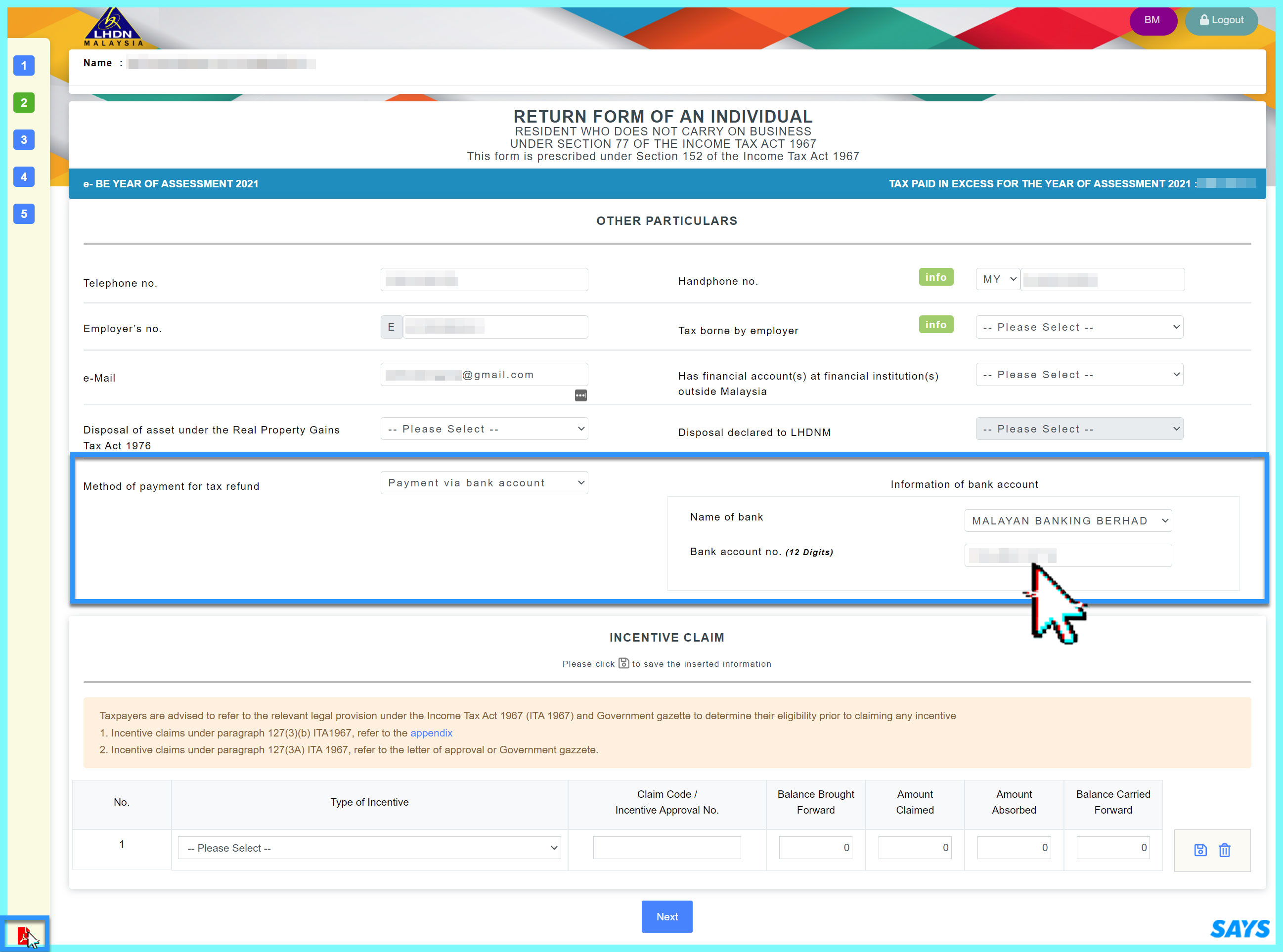

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

How To Check Income Tax Number Malaysia Online

How To File Income Tax For The First Time

How To Step By Step Income Tax E Filing Guide Imoney

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Pdf The Role Of Income Tax System Structure In Tax Non Compliance Behaviour Among Smes In Yemen

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Tax Guide For Expats In Malaysia Expatgo

.png)

Comments

Post a Comment